Fashion Evolution

My relationship with my clothes has been evolving during the pandemic.

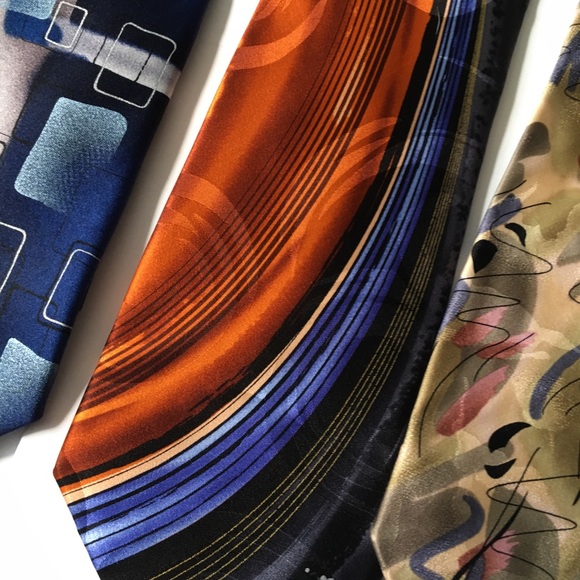

I have my own style. For a long time, I have chosen to wear light-colored dress shirts, rather than white shirts, for business and other formal occasions. Through the years, before the pandemic, I accumulated a collection of sport jackets, dress slacks, shirts, and Jerry Garcia ties. I wore them when I met with clients, attended dressier cultural events, or went to religious services.

During the pandemic, I have continued to do all three of these activities, although through Zoom and in a more limited way. But the clothes I wear has changed dramatically, even for those activities. Now I dress much more casually.

Lately, I’ve been experimenting not just with the clothes I wear but even how I wear them. For example, in the past, I may have worn a colored t-shirt underneath a nice casual long-sleeved shirt. Now, I may wear the same colored t-shirt on top of the long-sleeved shirt. Because I can and want to.

A friend of mine, age 83, just bought a pair of blue jeans and is wearing jeans for the first time in his life. This was a big deal for him. For him it was taking on a new identity.

I have been suspecting for some time that our behaviors would evolve as the pandemic progressed. Are these clothes-wearing changes related to the pandemic? If so, will we revert to our old style when the pandemic ends? Do these changes result from boredom or a sense of adventure?

We define ourselves by what we say and do. The clothes we wear are an announcement that we send to ourselves and to others about who we are. Any modifications we make to what we wear are a message to the world that we ourselves have changed, that we have different identities in this time of the pandemic.

Are you wearing different clothes recently? What message do you want to send out to others?

Cut Out To Be

I‘ve known since 8th grade what I would become. The career preference test I took then listed two occupations way above any other alternatives: accountant and professor. Plus one of my hobbies at that time was analyzing and charting stocks. It was clear to anybody that knew me that I was an analytical numbers guy, even then. I assumed that was what I was cut out to be.

Now, more than 65 years later, I am not so sure anymore.

With those 8th grade goals in mind, I proceeded on a straight-line path for at least a few decades. I went to school in the post-Sputnik years when science was a great career alternative. I liked chemistry right away. The introductory chemistry course seemed like a straightforward application of algebra, which was easy for me. Also, my favorite and much older cousin, who was a chemistry professor, inspired and mentored me.

I changed careers slightly after graduate school. First, I was an Assistant Professor of Biochemistry at University of Massachusetts at Amherst. Then I was a Systems Analyst in the computer area for a few years.

Then something unexpected happened. I decided to work in the financial area. I had a choice between being an investment analyst – analyzing the numbers for investment alternatives – or becoming a financial planner – working with individual clients to help them reach their goals. I chose the latter.

Somewhere along the way I had realized that I needed to be with and help other people. On those days when I had worked by myself the whole day, I became depressed by day’s end.

I have been basically self-employed for the last 35 years. It has been my choice what, when and where to do my work. I have gradually migrated from numbers to people.

In looking back, I am a little surprised about how my migration turned out. The transformation happened over many years.

I love what I do, especially when I have a positive impact on people’s lives. Although I am “semi- retired,” I have no intention of quitting anytime soon.

Have you become what you’re cut out to be?

Please let me know:

- Topics you would like me to write about.

- What I can do to help you.

Mark Fischer, Retirement Coach

Travel

I love to travel with my wife Lucy Rose for so many reasons. It is generally exciting and fun to see new places with her. An ideal trip may be some combination of walking through nature and moseying through a cosmopolitan city. I love to explore and have adventures.

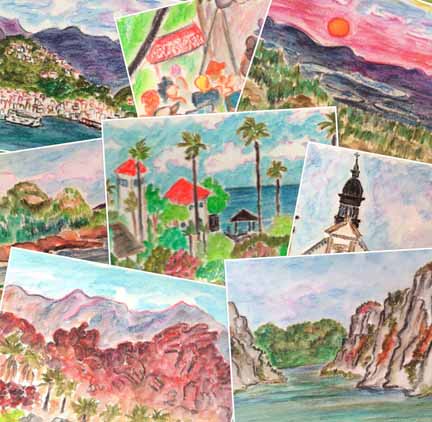

I bring my camera; she brings her sketchpad. When we come back, she will typically spend a few days reviewing the photos and sketches to identify the best ones. She then makes a digital souvenir book and orders it. Then we wait another week until we get the book back. The book contains both photos and sketches.

We generally order four copies of the book. We keep one for ourselves. Two copies go to our son, one of which goes to our daughter-in-law‘s mother. And one goes to my aunt who lives in Florida.

We have gone through this process for many years. We do a lot of travel, so we have quite a collection by now. We look through our copy many times and then put it on the shelf. Occasionally, we’ll take a book out and look at it to generate some smiles.

Right now, travel is not a possibility. We are in a high-risk group – older and having pre-existing medical conditions. We are extra-careful and will not go on a plane, or restaurant, or theater. We miss our traveling.

Recently, we tried an experiment. We checked a couple of our recent travel books out of our own library. We went through them slowly, page-by-page. Both of us were surprised how much we enjoyed that experience. Our travel restriction didn’t make us upset as I had expected it might.

I remember hearing about old people who live in the past. They couldn’t get around very much. All they could do was to reminisce.

So, whether we are really old ourselves or not so much, we will remember our past good times for now. When there is an effective vaccine and we’ve had our shots, I anticipate we’ll do more traveling and have more adventures.

Are you traveling now? If not, what are you doing in its place?

Please let me know:

- Topics you would like me to write about.

- What I can do to help you.

Assembly required

Those dreaded words – “Some assembly required” – just arrived. Winter is here, and I bought a stationary bike for my home. I need exercise indoors. During the pandemic I’m not comfortable going to the gym. The bike came in a cardboard box, in pieces, and needed to be put together.

I love to assemble words and numbers and ideas. Objects – not so much. My history of assembling objects has not been pretty. In fact, I break into a cold sweat when facing a project like this.

The instructions were written in multiple languages, including broken English. They included a long list of parts, complicated diagrams, but only four steps in the instructions.

Although the components included a large number of nuts, bolts, and screws, I couldn’t find the package of them when I took out parts and spread them over the floor. I looked again through the plastic and Styrofoam packaging. Nope.

I read the instructions in more detail and realized that the bike was pre-assembled. The hardware was actually there, in all the right places. I just had to unscrew the screws, put some pieces together and re-screw the screws.

I marveled at the changes in technology. Even I could put the pieces together. It took me only 2½ hours to complete the “30-minute” job. When I was done, my wife called me a hero for completing it.

Now, I enjoy having a bike – and being a hero too.

How can you feel like a hero during the pandemic?

Our spending plan

I am excited to report that my wife and I have completed the first full year of our spending plan. Our goal was to understand and manage our expenses. The result of this has been a year of learning and surprises for us.

Our first step in managing our retirement finances was to do financial projections – how long would our money last, based on how much money we planned to spend. The question we answered was the amount of money we could take out of our investments and still have enough for the rest of our lives.

Now it was time to start tracking how we were doing. We chose to start a quarter year before I “retired.” I knew that we would be moving into a new phase of our life. Instead of living off our incomes from work, our income would come primarily from Social Security, pensions, and savings.

We found this quarterly-review process to be extremely helpful for many reasons, some unexpected.

- We learned a lot about where our money was going. As a result, we decided to decrease some expenses and increase others. Those decisions improved the quality of our lives.

- By working on this together as a couple, we ended up on the same page – with a common understanding and plan.

- When unexpected opportunities (expenses) presented themselves during the year, we were able to consider them more intelligently. We changed the question from “Can we afford to do it” to “How can we do it through postponing some other expenses.”

- What we learned gave us a sense of power and control over our lives. This turned out to be helpful in the time of the pandemic.

- We had already done projections about how long our money would last. We were able to see that we continue to be on track – our money should last longer than we do. That understanding took some of the edge off the question – will we have enough for the rest of our lives.

Even before we started, we knew that tracking expenses was going to be a lot of work. The first step in our process to get a handle on our money was to develop the categories of our expenses. Some expenses were predictable and frequent, such as groceries and rent. Car insurance happened predictably but only once or twice each year. Many expenses were as needed (or wanted) including travel, eating out, clothes, gifts, household expenses, etc.

Then we developed estimates for each category. We reviewed the last few years of expenses that we had been entering on Quicken, a popular money-tracking computer application. For more details on this step or if you don’t use Quicken, see Chapter 11 entitled “Enough Money for What?” in my book Serious About Retiring – see below in this email.

At the end of each quarter, after we had received our bank and credit card statements, we entered the detailed information into Quicken, downloaded the quarter’s information onto an Excel spreadsheet, sorted it, and voila we knew our expenses for the last quarter.

In each quarter there were many surprises. Some expenses turned out to be higher than expected, some lower. If we needed to figure out the source of the discrepancy, we had the details to discover where our money was really going. Was this a one-time difference from what we had expected, or not? What, if anything, did we want to do about it?

This whole process became easier to do as the year progressed. We got better at it. We have recently revised our spending plan for the next year and expect to continue this process for the foreseeable future.

I recommend that you consider having and using your own spending plan. It is one of the most fundamental steps you can take as you prepare for retirement.

Do you have to do this? No. Look at the benefits that we experienced (see above) and decide if they are important enough to you to proceed in this direction.

What are your plans to manage your money in retirement?